In the vast and unpredictable world of marine cargo transportation, ensuring the safety and security of goods is a top priority for shippers and carriers alike. One crucial facet of this protection is marine cargo insurance, specifically the Free of Particular Average (FPA) policy. Serving as a safeguard against potential losses and damages, FPA insurance plays a vital role in the complex web of logistics, transport, and shipping. Join us as we delve into the intricate world of FPA insurance and discover the crucial role it plays in the maritime industry.

Understanding Marine Cargo Insurance: FPA Coverage Explained

When it comes to marine cargo insurance, understanding the different coverage options is crucial for protecting your shipments during transportation. One important type of coverage to consider is FPA, which stands for Free of Particular Average. FPA coverage provides protection for goods that are lost or damaged due to specific perils such as fire, sinking, collision, and grounding.

With FPA coverage, it’s important to note that partial losses are not covered unless they are caused by a general average sacrifice. This means that if your goods suffer partial damage during transit that is not due to a specified peril covered by the policy, you may not be compensated for the loss. It’s essential to carefully review and understand the terms and conditions of your FPA policy to ensure you have adequate protection for your cargo.

Benefits of Choosing Free of Particular Average (FPA) for Your Cargo

FPA, or Free of Particular Average, is a type of marine cargo insurance that provides coverage for specific risks during transit. Choosing FPA for your cargo can offer various benefits that help protect your shipments and reduce potential financial losses. One of the main advantages of FPA insurance is that it covers total losses caused by specific peril, such as sinking of the vessel, fire, or stranding, giving you peace of mind knowing that your goods are protected in case of unforeseen events.

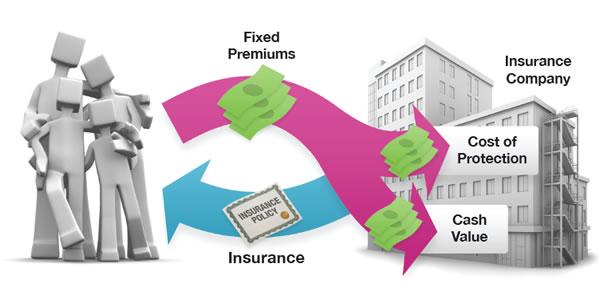

Moreover, FPA policies typically come at a lower premium compared to other types of marine cargo insurance, making it a cost-effective choice for businesses looking to safeguard their shipments without breaking the bank. By opting for FPA coverage, you can ensure that your cargo is protected during transit, and in the event of damage or loss, you can file a claim to recover the value of your goods. Overall, choosing FPA for your cargo can provide you with comprehensive coverage and financial security, making it a smart choice for businesses involved in logistics, transport, and shipping.

Key Considerations When Selecting FPA Insurance for Shipping

Understanding the scope of coverage: When selecting FPA insurance for shipping, it is crucial to carefully review the policy to understand the extent of coverage it provides. FPA insurance typically covers losses resulting from total loss or damage to the cargo during transit, but may exclude certain types of losses such as partial damage or losses due to specific causes.

Comparing premiums and deductibles: Another key consideration when choosing FPA insurance is to compare premiums and deductibles offered by different insurers. It is important to strike a balance between affordable premiums and reasonable deductibles to ensure adequate coverage without breaking the bank. Additionally, consider any additional benefits or services offered by insurers to make an informed decision.

Maximizing Protection and Minimizing Risks with FPA Coverage

When it comes to protecting your marine cargo, FPA coverage is essential for minimizing risks and ensuring maximum protection. With FPA coverage, you can rest assured that you are covered for a wide range of potential risks that your cargo may face during transportation. From accidents to theft, FPA coverage offers comprehensive protection for your valuable cargo.

By investing in FPA coverage, you can mitigate the financial risks associated with transporting goods by sea. This type of insurance provides peace of mind knowing that your cargo is protected in the event of unforeseen circumstances. With FPA coverage, you can focus on your core business without worrying about the potential risks that come with shipping goods internationally. Ensure the safety of your cargo with FPA coverage and minimize risks along the way.

The Way Forward

In conclusion, Marine Cargo Insurance with the Free of Particular Average (FPA) coverage is an essential aspect of logistics, transport, and shipping. By protecting against various risks and uncertainties that can arise during the transit of goods, FPA insurance provides peace of mind to both shippers and receivers. Understanding the importance of this type of insurance can help businesses navigate the complex world of international trade with confidence. Whether transporting goods by sea, air, or land, having FPA coverage ensures that your cargo is secure and your investments are safeguarded. Stay informed and stay protected – FPA insurance is the key to seamless shipping operations in the volatile world of global trade.