In the fast-paced world of Logistics, Transport, and Shipping, ensuring the safety and security of goods in transit is paramount. One vital tool that plays a crucial role in this field is the Certificate of Insurance. This document not only provides proof of insurance coverage but also serves as a key component in safeguarding businesses from potential risks and liabilities. Join us as we delve into the intricate world of Certificate of Insurance in the realm of Logistics, Transport, and Shipping.

Understanding the Importance of a Certificate of Insurance

When it comes to the logistics, transport, and shipping industries, having a Certificate of Insurance is crucial. This document serves as proof that a company has the necessary insurance coverage to protect against any potential liabilities that may arise during the course of business operations. Without a valid Certificate of Insurance, companies in these industries may face significant risks and potential legal issues.

Having a Certificate of Insurance provides peace of mind for all parties involved in the transportation and shipping process. Whether it’s a supplier, carrier, or buyer, knowing that the company they are working with is properly insured can help build trust and confidence in the business relationship. In addition, a Certificate of Insurance can also help businesses secure contracts with larger clients who often require proof of insurance before entering into agreements. Overall, is essential for the success and protection of companies in the logistics, transport, and shipping industries.

Key Components to Include in a Certificate of Insurance for Logistics

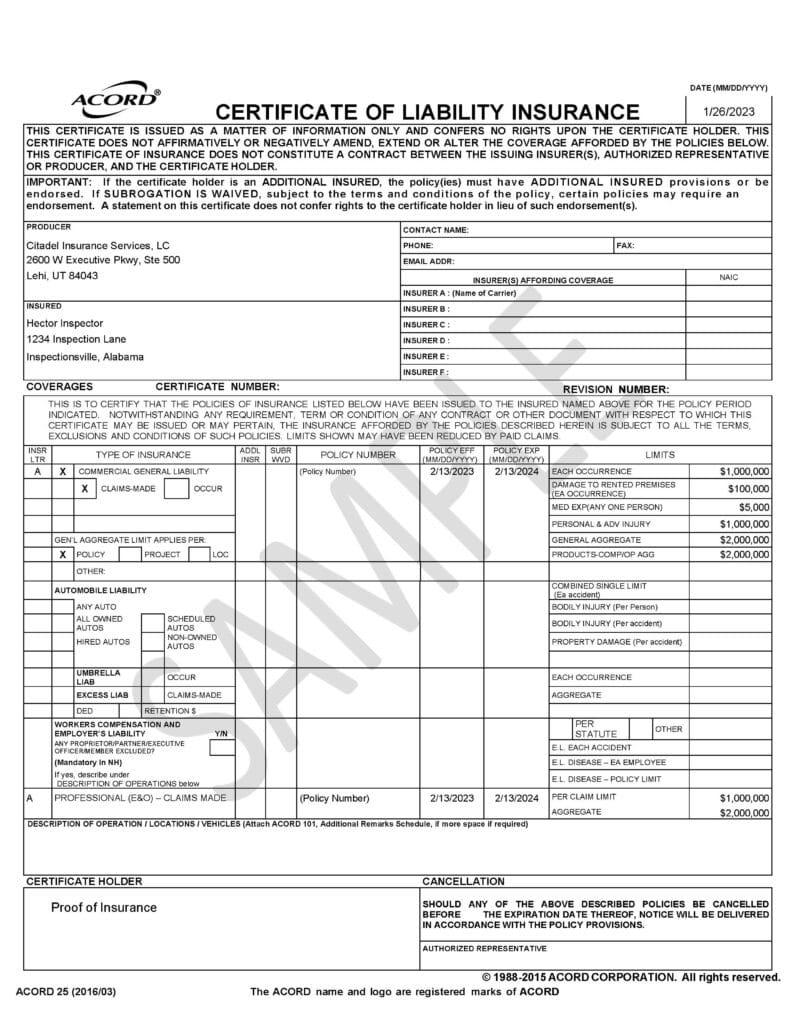

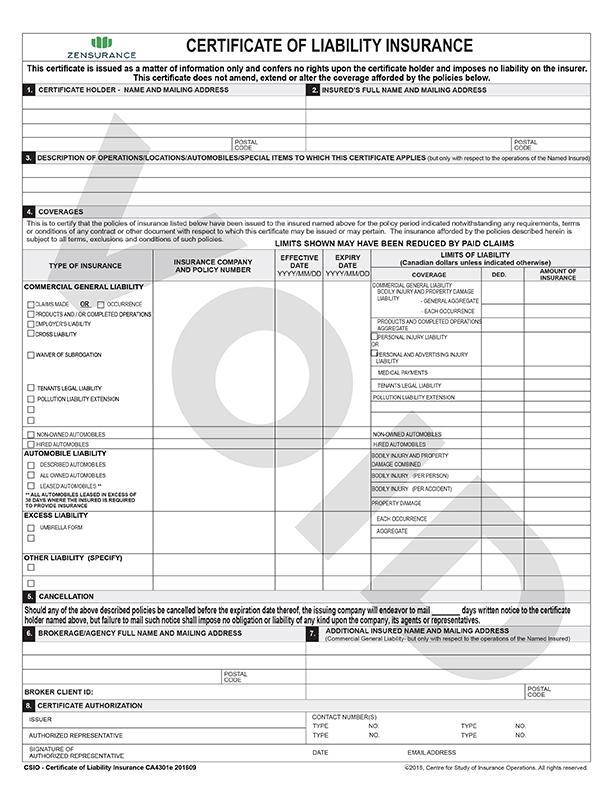

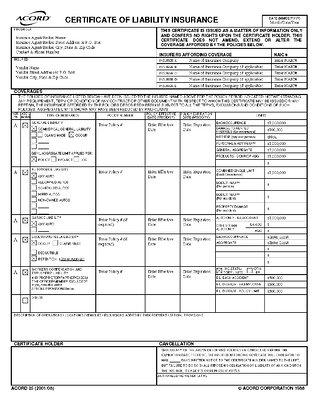

Certificate of Insurance Logistics – Transport – Shipping

When creating a Certificate of Insurance for logistics, it is important to include key components that will provide essential information to all parties involved. Some of the crucial details to include are:

- Policyholder Information: List the name of the insured individual or company.

- Insurance Coverage: Clearly outline the type and amount of coverage provided. This can include general liability, cargo insurance, and other relevant policies.

- Policy Number: Include the unique identifier for the insurance policy to easily track and reference.

- Effective Dates: Specify the start and end dates of the coverage to ensure validity.

Additionally, consider including any special endorsements or specific requirements requested by clients to ensure all parties are protected in the event of any unforeseen incidents. By including these key components in the Certificate of Insurance for logistics, you can provide transparency and clarity for all parties involved in the transport and shipping processes.

Best Practices for Handling Certificate of Insurance in Transport and Shipping Operations

When it comes to handling Certificate of Insurance in transport and shipping operations, there are several best practices that can help ensure smooth and efficient processes. One key practice is to always verify the authenticity of the certificate to avoid any potential fraud or misinformation. This can be done by cross-checking the details provided on the certificate with the insurer’s records.

Another important practice is to maintain accurate and up-to-date records of all certificates received and processed. This not only helps in keeping track of compliance requirements but also enables quick access to information when needed. Utilizing a digital system for managing and storing certificates can streamline these processes and help in efficiently handling the Certificate of Insurance in logistics, transport, and shipping operations.

Closing Remarks

In conclusion, obtaining a Certificate of Insurance is a crucial step in protecting your business and ensuring smooth operations in the logistics, transport, and shipping industries. By understanding the importance of this document and its contents, you can safeguard your assets, mitigate risks, and maintain strong relationships with clients and partners. Do not hesitate to seek guidance from insurance professionals to tailor your coverage to meet your specific needs. With a Certificate of Insurance in hand, you can navigate the complexities of the industry with confidence and peace of mind.